Discover what MBO Partners can do for you

Setting Up a Formal Business Structure

If you do not already have a formal business structure, MBO Partners helps you set up a Limited Liability Company (LLC). The main reason for forming an LLC is to separate your personal affairs from your business, while also allowing you to take advantage of certain benefits of this business structure (outlined below).

An LLC is a business entity that is separate from its owner, similar to a corporation. An LLC is a "pass-through" tax entity, meaning that the profits and loss of the business pass through to you as the business owner. These profits and loss are then accounted for on your personal tax return.

Note: If you already have a business entity/structure, MBO will work with you to ensure compliance for work with your client, as needed and if possible.

Benefits of Forming an LLC with MBO Partners

Forming an LLC with MBO gives you simplicity and protection:

- No need to fully incorporate - less complex than a corporation with less regulation

- No double taxation - only pay personal taxes, not business

- Potentially eligible for 20% pass-through tax deduction outlined in the new tax code

- Easily separate your personal affairs from your business obligations

- Personal assets protected by the LLC business structure - you are not personally responsible for debts or liabilities of your business

How MBO Helps You Form an LLC

Forming an LLC with MBO Partners is a simple process and we help you every step of the way.

Stay tuned for more information from MBO on next steps. If you aren't sure what's needed, reach out to your MBO point of contact at any time.

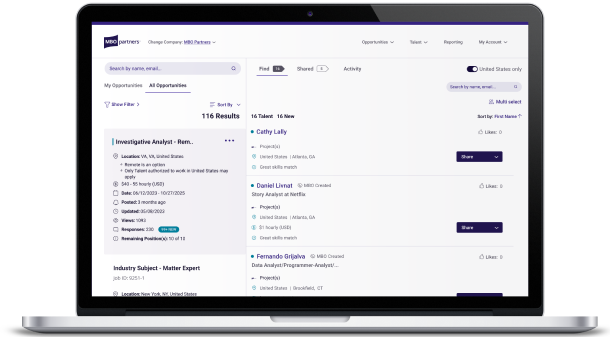

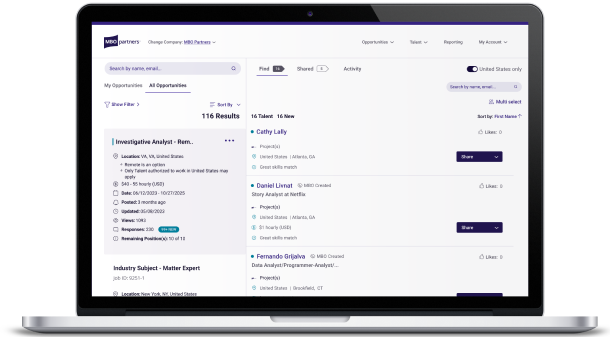

Haven't joined MBO's marketplace yet?

Sign up today and search for projects with top companies in MBO's network.