Discover what MBO Partners can do for you

Health Savings Account

A Health Savings Account (HSA) provides tax savings opportunities for those enrolled in a qualified High-Deductible Health Plan (HDHP). Eligible participants can elect to contribute up to $4,150 for single coverage and up to $8,300 for family coverage in 2024.

HSA funds can be used to pay for qualified medical, dental, and vision out-of-pocket expenses for you and your eligible dependents. With an HSA, you will never have to forfeit the money you have deposited. Unused funds roll over year after year, earning tax-free interest.

How do I Enroll?

To enroll in the HSA, complete the HSA application and return it directly to ABG for processing.

Fax the form to 877-723-0147 or email* it to processing@amben.com. *If emailing, please encrypt or password-protect the document, sending the password and application in separate emails as the application will contain sensitive personal information.

Once you have enrolled, you can register to access ABG's Wealthcare Portal, which will allow you to manage your account online.

MBO's HSA Program

MBO has partnered with American Benefits Group (ABG) to administer our HSA program. ABG has created an MBO-specific program offering, including benefits such as:

- The ability to contribute to the HSA post-tax and the ability to realize tax savings by claiming the deductions when filing your annual taxes

- Eligible healthcare purchases can be made tax-free when you use your HSA and purchases can be made directly from the HSA account either via benefits debit card, ACH, online bill-pay, or check

- The ability to submit qualified insurance premiums and medical expenses through the HSA

- The interest on HSA funds grows on a tax-free basis and is not considered taxable income when the funds are used for eligible medical expenses

- The program allows reimbursement of up to $4,150 for individuals or $8,300 for families (2024 values) in out-of-pocket medical expenses annually, with any unused portion eligible for rollover into the next year

- Individuals aged 55 and over may make an additional $1,000 catch-up contribution

- HSA funds can be invested once you reach a certain threshold; note that the ABG HSA option requires a minimum balance of $1,000 before funds can be invested

Am I eligible to enroll?

You are eligible to establish and contribute to an HSA if:

- You are enrolled in a qualified HDHP; and

- You are not covered under a traditional Health Care Flexible Spending Account (FSA) through your own or your spouse's employment (a Limited Purpose Health Care FSA that is designed to work with an HSA is allowed); and

- You are not currently enrolled in Medicare or TRICARE; and

- You have not received medical benefits through the Department of Veterans Affairs (VA) during the preceding three months; and

- You are not claimed as a dependent on anyone else's tax return.

How much does the Program Cost?

There are some fees that are associated with HSA accounts. The fees can be viewed here.

Additional Information

If you need assistance with your HSA account, you can contact ABG directly at 1-800-499-3539 (select option 2 for the Flex Department) or at support@amben.com.

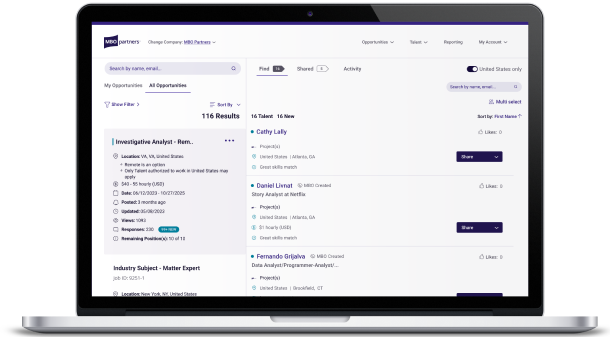

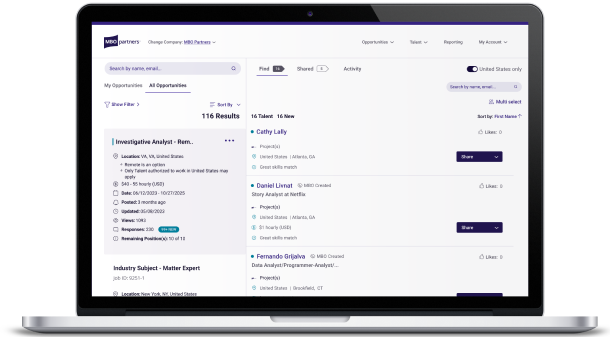

Haven't joined MBO's marketplace yet?

Sign up today and search for projects with top companies in MBO's network.