Discover what MBO Partners can do for you

Why Do You Need Business Insurance?

Holding business insurance is important for those who own and operate their own business.

Business insurance:

- Protects you and your business from unforeseen risks and liabilities

- Positions you as an enterprise-grade business, equipped to provide services for top companies

- Fulfills client requirements, giving you an edge when bidding on a contract

- Guards your clients against liability issues, so they can continue engaging independent professionals

How MBO Helps With Business Insurance?

Often, clients require complex insurance policies that are burdensome and costly for a small business to obtain - especially if you are engaging that client for a short-term project.

The great news is that MBO Partners provides coverage for you under our comprehensive suite of business insurance policies when you work through one of our client programs. This means you automatically meet the client's insurance requirements with ease. It's important to note that for these engagements, you are required to maintain general liability insurance, which we verify upon setting up your MBO account. For all other types of insurance, we have you covered.

If your business needs additional insurance, we've found that Bunker offers good insurance quotes.

To get started, visit Bunker's landing page for MBO clients. A Bunker advisor is available to guide you throughout the process.

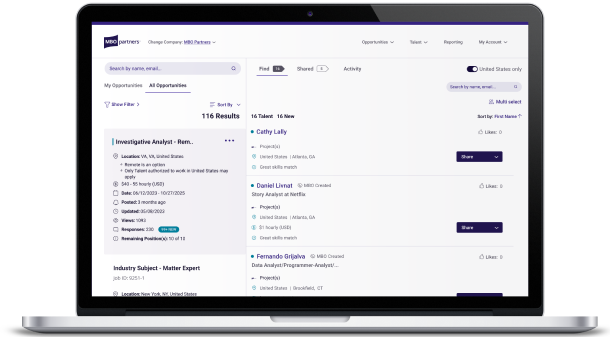

Haven't joined MBO's marketplace yet?

Sign up today and search for projects with top companies in MBO's network.