6 Consulting Frameworks for Small Business (Guide + Worksheets)

Business frameworks assist independent professionals in getting client agreement and buy-in on project goals, scope, and deliverables. Use of a consulting framework can be helpful not just in achieving buy-in from a client, but also in identifying and understanding of all aspects of the issue at hand, leading to a successful final product—and happier clients.

The frameworks included in this guide are commonly used models. There is no winner or best framework, as each serves a different purpose. These frameworks can be used individually or in tandem to frame thinking and increase project efficiency.

GATE

The 3Cs Strategy Model

The 3Cs model is a classic strategy model. Whether you are a management consultant hired to improve costs, or a technology consultant tasked with adding infrastructure, the 3Cs model can help with analyzing intrinsic and extrinsic factors to develop sustainable solutions.

The 3Cs—customer, competition, company—is a strategy framework developed by Japanese strategy guru Kenichi Ohmae. This model asserts that in the construction of a business strategy, information gathering, and analysis should be centered on three key factors: the customer, the competition, and the corporation. Proper analysis can help companies achieve a sustained competitive advantage.

According to Ohmae, it’s only by integrating these three Cs that a sustained competitive advantage can exist. Think of these key factors as the strategic triangle of independent contracting. As an independent, you are able to set a flexible schedule and work from home, but you are also responsible for providing your own job security. It’s important to think through both the financial and emotional considerations of supporting your own income.

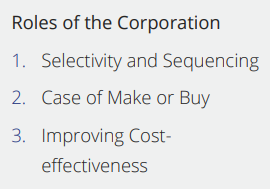

CORPORATION

A corporation needs strategies to maximize its strengths relative to the competition in the functional areas that are critical to success in the industry. The corporation plays roles such as:

- Selectivity and sequencing: The company does not have to have a clear lead in every function in order to win. If it can gain a decisive edge in one key function, it will eventually be able to pull ahead of the competition in other functions that may currently be standard.

- A case of make or buy: When faced with rapidly rising wage costs, it becomes a critical decision for a company to subcontract a major share of its assembly operations. Its competitors may not be able to shift production so rapidly to subcontractors and vendors, and the resulting difference in cost structure and/or in the company’s ability to cope with demand fluctuations could have significant strategic implications.

- Improving cost-effectiveness: Cost-effectiveness can be improved in three ways:

1. By reducing basic cost more effectively than the competition.

Example: Taking a bigger step to look at labor costs differently than others in the same industry and leverage technology to increase operating efficiency.

2. By exercising greater selectivity in orders accepted, products offered, or functions to be performed.

Example: Reducing the product line and removing low-performing items that use disproportionate resources.

3. By sharing the cost burden of certain shared functions among the corporation’s other businesses or even sharing these resources with other businesses.

Example: Outsourcing accounting or finance to a third-party firm.

COMPETITION

According to Ohmae, proper analysis of the firm includes looking at where business functions stand out versus the competition. This analysis ranges from purchasing and design, to engineering, sales, and servicing. Analysis strategies may include:

- The power of an image: When product performance and mode of distribution are difficult to differentiate, image may be the only source of positive differentiation.

- Capitalizing on profit/cost-structure differences: Companies can exploit the difference in source of profit, such as profit from new product sales or profit from services. Another option is to strategically exploit the difference in the ratio of fixed cost to variable cost. For example, a company with a lower fixed cost ratio can lower prices in a sluggish market and win market share.

- Hito-Kane-Mono: A favorite phrase of Japanese business planners is hito-kane-mono, or people, money, things—fixed assets. They believe that streamlined corporate management is achieved when these three critical resources are in balance without any waste. Of these three critical resources, funds should be allocated last. The corporation should first allocate management talent based on the available mono (things), such as plants, machinery, technology, process know-how, functional strengths, and so on. Once these hito (people) have developed creative ideas to capture the business’ upward potential, the kane (money) should be allocated to the specific ideas and programs generated by individual managers.

CUSTOMER

Ohmae prioritized the customer, saying, “There is no doubt that a corporation’s foremost concern ought to be in the interest of its customers rather than that of its stockholders and other parties. In the long run, the corporation that is genuinely interested in its customers is the one that will be interesting to investors.” Ohmae argued the following regarding the customer:

- Segmenting by objectives: Differentiation is done in terms of the different ways different customers use the product. For example, some people drink coffee to boost their energy, while others drink it to relax or socialize.

- Segmenting by customer coverage: This type of strategic segmentation emerges in comparison to the spend of its competitors. In the cost-versus-coverage relationship, there is often a point of diminishing returns. As a result, the corporation is tasked with optimizing its range of market coverage (geographical or channel) so that its marketing costs of marketing remain advantageous relative to the competition.

- Re-segmenting the market: In a fiercely competitive market, the corporation and its head-on competitors are likely to be evaluating the market in similar ways. Over time, the effectiveness of a given initial strategic segmentation will tend to decline. When this occurs, it’s beneficial to select a small group of key customers and reassess what they are looking for in the market.

- Changes in the customer mix: Market forces can alter the distribution of the user mix over time by influencing distribution channels, demography, customer size, and other factors. The market segment change calls for shifting the allocation of corporate resources and/or changing the level of resources committed in the business.

One of the key roles of an independent consultant is problem-solver.

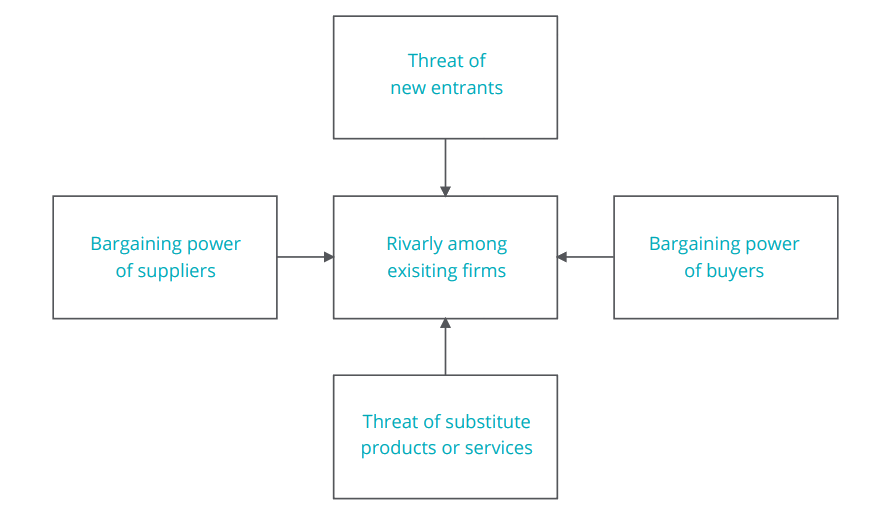

Porter's 5 Forces

Porter’s Five Forces is a useful tool in helping you to harness the power of your current competitive position and any future positions you might hold. You can use the insights to leverage your strengths, improve your weaknesses, and avoid making missteps. Whether assessing your own business plans—such as transitioning form employee to independent consultant, working with clients to assess the value of adding a new product or service, or moving into a new market—Porter provides a framework to aid you in making strategic decisions.

Traditionally, Porter’s Five Forces model has been used to identify whether new products, services, or businesses have the potential to be profitable. This model can help you to understand the strength of your current competitive position as well as the position you may be considering moving into in the future.

The five forces that Porter suggests drive competition are:

- Threat of new market entrants: A market that is profitable and yields high returns will attract many new entrants and can weaken your market position. If you have strong and durable barriers to entry—such as protection of your key technology, economies of scale, and brand equity—you can preserve and leverage a favorable position.

- Bargaining power of buyers: If you only deal with a few powerful buyers, there is a risk that they can dictate terms to you and drive down pricing. Considerations for assessing the bargaining power of buyers include number of customers, size of orders, price sensitivity, and switching costs, and availability of substitutes.

- Existing competitive rivalry between suppliers: Your position is impacted by the number of your competitors and their capabilities. If you have many competitors that offer equally attractive products and services, buyers and suppliers can go elsewhere if they don’t get a good deal from you. On the other hand, if no one else can do what you do, you have tremendous competitive strength.

- Power of suppliers: If you have a small number of suppliers who provide a unique product or service for key inputs, there is a risk that they can drive up your supplier prices. The number of suppliers, uniqueness of offerings, and costs of switching are all factors to consider when evaluating how powerful your suppliers are and how easily they can drive up prices.

- Threat of substitute products (including technology change): If substitution is easy and viable, it can weaken your power in the market. For example, if a company supplies a unique software product that automates a key process, buyers may substitute by outsourcing or doing the process manually.

"Porter’s five forces have shaped a generation of academic research and business practice.”

– Editor, Harvard Business Review

SWOT and PEST

Successful independent consultants are often skilled planners. However, before you formulate a plan, you must understand where you are and what factors will help or hinder your success.

SWOT and PEST are simple but useful frameworks that can be used to launch a strategy formulation process or as a more sophisticated strategy tool. You can use these frameworks in the proposal process to gain a deeper understanding of your client’s business, present how your solutions align with their needs, or guide decisions on client projects.

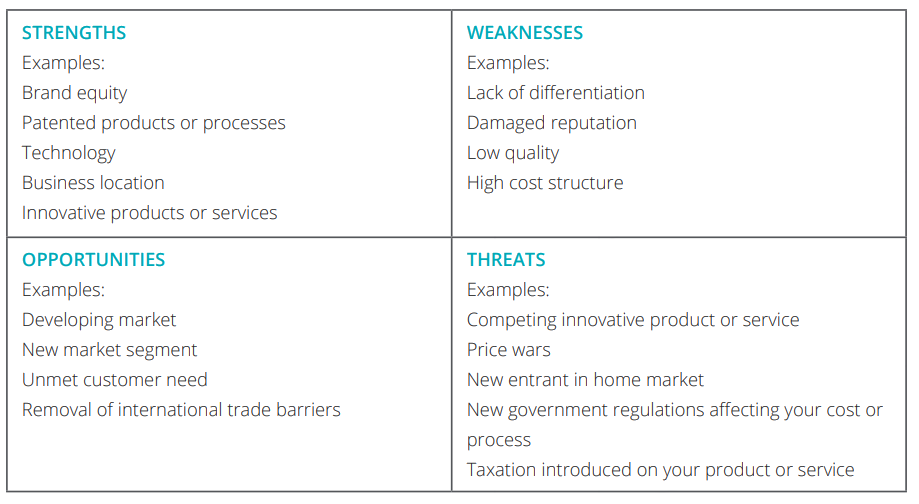

SWOT Analysis

The SWOT Analysis framework is used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business venture or project.

- Strengths: Characteristics of the business or project team that give it an advantage over others.

- Weaknesses (or Limitations): Characteristics that place the team at a disadvantage relative to others.

- Opportunities: External chances to improve performance (e.g. make greater profits) in the environment.

- Threats: External elements in the environment that could cause trouble for the business or project.

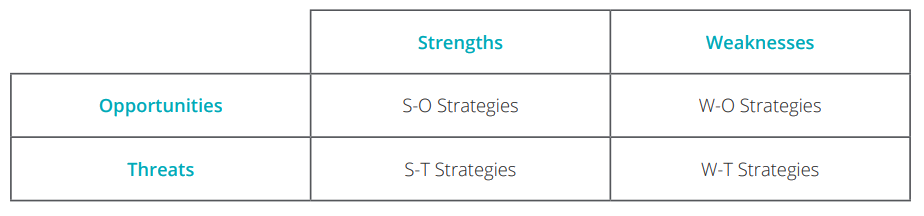

SWOT MATRIX

The SWOT matrix (also known as a TOWS matrix) can help you to develop strategies that take the SWOT profile into account.

- S-O Strategies pursue opportunities that are a good fit to the company’s strengths

- W-O Strategies overcome weaknesses to pursue opportunities

- S-T Strategies identify ways that the company can use its strengths to reduce its vulnerability to external threats

- W-T Strategies establish a defensive plan to prevent a company’s weaknesses from making them highly susceptible to external threats

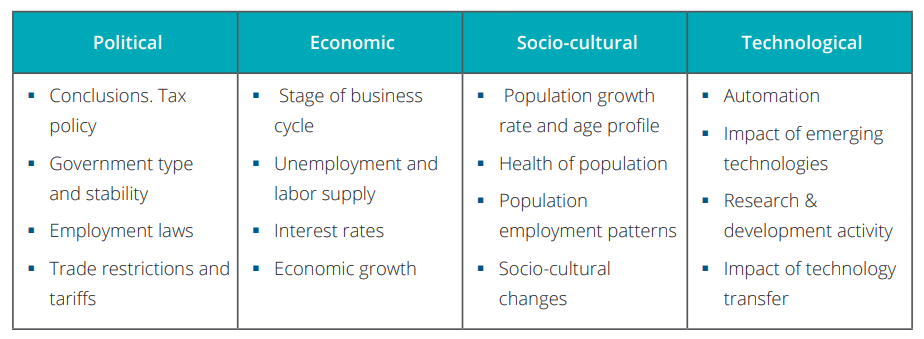

PEST ANALYSIS

PEST helps you understand the broader Political, Economic, Socio-Cultural, and Technological environment in which you operate. This analysis is a helpful tool when you are beginning operations in a new country or region. Use the prompts of PEST to brainstorm relevant factors. Next, identify information that applies to the factors. Then, you can draw conclusions from your research.

Develop and assess multiple strategies before deciding which path will be most successful.

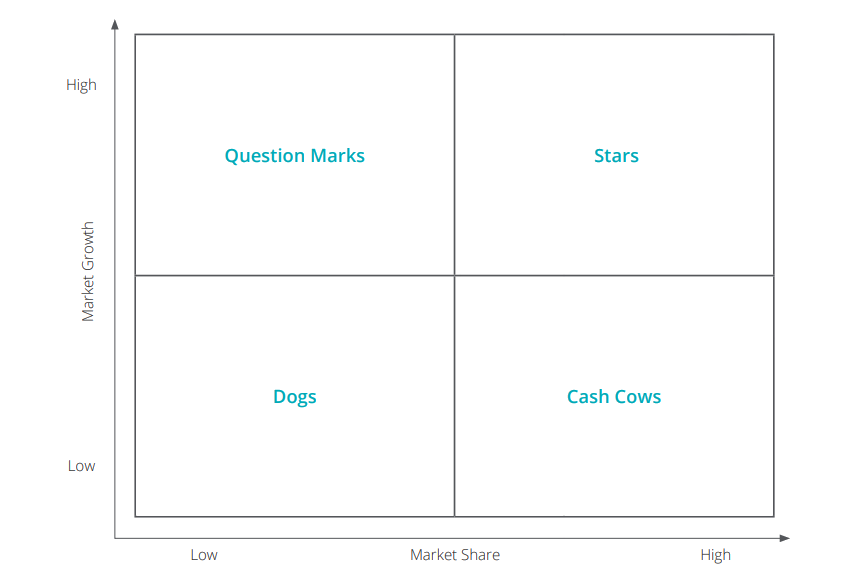

BCG Matrix

When working with large clients with multiple products, services, or business units, you may be asked to help assess the best use of resources. The BCG Growth-Share Matrix provides a framework for deciding how to use resources.

This framework is also helpful in assessing each product or business unit’s ability to continuously generate profit. Are there products or services that bring in major cash, but have no room for growth? Which products or services have high market share and high potential for growth? The BCG can help you answer these questions and formulate a strategy for your business or your client’s business that will ensure a strategic deployment of resources to maximize return.

The BCG Growth-Share Matrix was developed by Boston Consulting Group in the 1970s. The model was developed to manage a portfolio of different business units or major product lines. The BCG displays the various business units or product lines on a graph of the market growth versus market share relative to competitors. Resources are allocated to each category according to where they are on the grid:

QUESTION MARKS: LOW MARKET SHARE/HIGH MARKET GROWTH

Question Marks might become Stars and eventual Cash Cows, but if nothing is done to change the market share, they could just as easily absorb effort with little return.

DOGS: LOW MARKET SHARE/LOW MARKET GROWTH

Companies often invest high dollars in turnaround plans for Dogs. Dogs struggled to gain attention and combined with low market growth, face challenges in achieving improvement.

CASH COWS: HIGH MARKET SHARE/LOW MARKET GROWTH

Products and business units in this quadrant are well-established, making it easier to get attention and to exploit new opportunities. However, the market is not growing, so opportunities are limited. Cash cows can help fund new Stars.

STARS: HIGH MARKET SHARE/HIGH MARKET GROWTH

Business units and products in this quadrant use large amounts of cash but are also leaders in the business, typically generating significant revenue.

The BCG Matrix is used for strategic allocation of resources but can also be used to project the trajectory of a company. Optimally, on a BCG Matrix, a business would continuously generate future Cash Cows or Stars.

Optimally, on a BCG Matrix, a business would continuously generate future Cash Cows or Stars.

The McKinsey 7S Framework

The McKinsey 7S Framework can help you identify and address internal organizational problems. Whether you have been hired to work with a new management team or are working on a project to develop and implement a new strategy, this tool can support your strategic analysis.

The McKinsey 7S Framework was developed by two McKinsey consultants. The framework is a useful tool in assessing organizational effectiveness. The basic premise of this framework is that there are 7 internal aspects of an organization that need to be aligned to ensure success.

There are many situations where it is helpful to gain an alignment perspective, including:

- To improve the performance of a company

- To align departments and processes during a merger or acquisition

- To determine the best way to implement a proposed strategy

- To examine the likely effects of future changes within a company

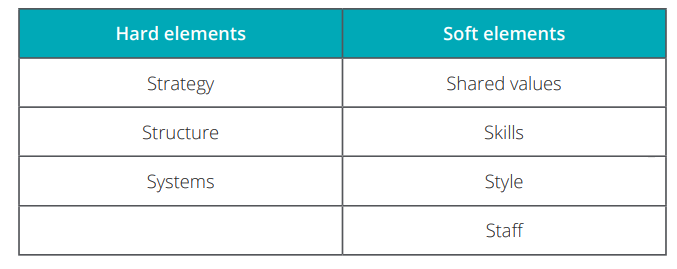

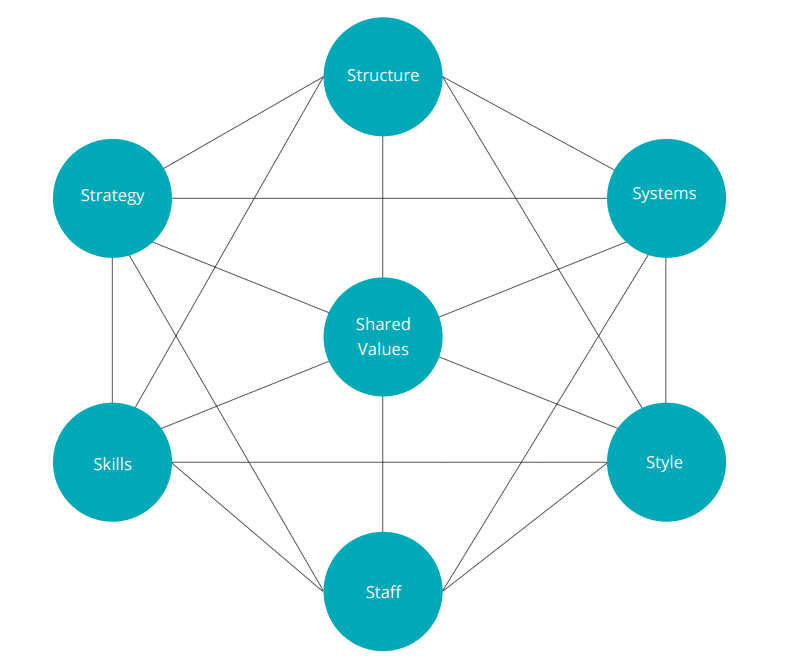

The 7 interdependent elements of the model are categorized as hard or soft elements:

Hard elements are easier to define than soft elements, and management can have a direct influence on them. These hard elements include strategy statements, organizational charts and reporting lines, and formal processes or IT systems.

Soft elements are as important as hard elements but are influenced more by the culture rather than by management. The 7S Model is based on the theory that all 7 elements need to be aligned and mutually reinforced for an organization to perform well. You can use the model to identify areas that need realignment or that need to maintain alignment during change such as restructuring, mergers, new systems, or change of leadership.

The illustration below depicts the interdependency of the elements.

SAMPLE QUESTIONS

To utilize the 7S model, identify key stakeholders and other relevant experts to gather information about the 7 elements. For example, to determine if an organization has clear goals and a vision that is communicated throughout the organization, you might ask: Does the organizational structure support existing goals and objectives?

Summarize the findings in a report that can be used for further discussion.

Depending on the element you are looking to evaluate, here are some sample questions you might ask:

- Strategy: Is there a clear vision along with goals that drive the organization? Are these shared among your entire team?

- Structure: How are the functions and roles of departments and units organized? What are the roles and responsibilities? Does the structure support strategic and organizational goals?

- System: Do HR, financial, and technological systems support objectives? Are there monitoring and evaluation systems in place?

- Style: What is the management style? What is the level of communication? How do managers spend their time?

- Staffing: Are staffing resources adequate? How effectively is the staff being used? What is the level of staff motivation?

- Skills: What are the organization’s core capabilities? What are they best at doing? Are there opportunities for training or knowledge sharing?

- Shared values: What are the organization’s values, customs, and principles that guide the organization’s behavior? To what extent are core professional values internalized?

MECE Framework

There is an old adage that says the best way to eat an elephant is one bite at a time. This wisdom can be applied to problem-solving as well. In business, many problems are not easily solved with black-and-white answers. You are often faced with problems that have overlapping issues. The MECE Framework helps to break down problems into distinct categories so it is easier to assess the problem along with proposed solutions.

The MECE Framework is one of the hallmarks of problem solving at McKinsey Consulting and has become widely used in the consulting industry. MECE stands for Mutually Exclusive and Collectively Exhaustive.

Mutually exclusive: Information should be grouped into categories so that each category is separate and distinct without any overlap

Collectively exhaustive: All categories taken together should deal with all possible options without leaving any gaps.

M utually

E xclusive

C ollectively

E xhaustive

According to the MECE principle, when solving any business problem such as, “How can we reduce costs?” or “How can we increase profits?”, all possible causes or options to be considered should be grouped into categories. There should be no overlap in categories (mutually exclusive) and all the categories together should cover all possible options (collectively exhaustive).

For example, taking your customers and grouping them by age group is an MECE principle because it is mutually exclusive—no individual can fall into more than one category—and collectively exhaustive—the groupings as a whole cover the entire population.

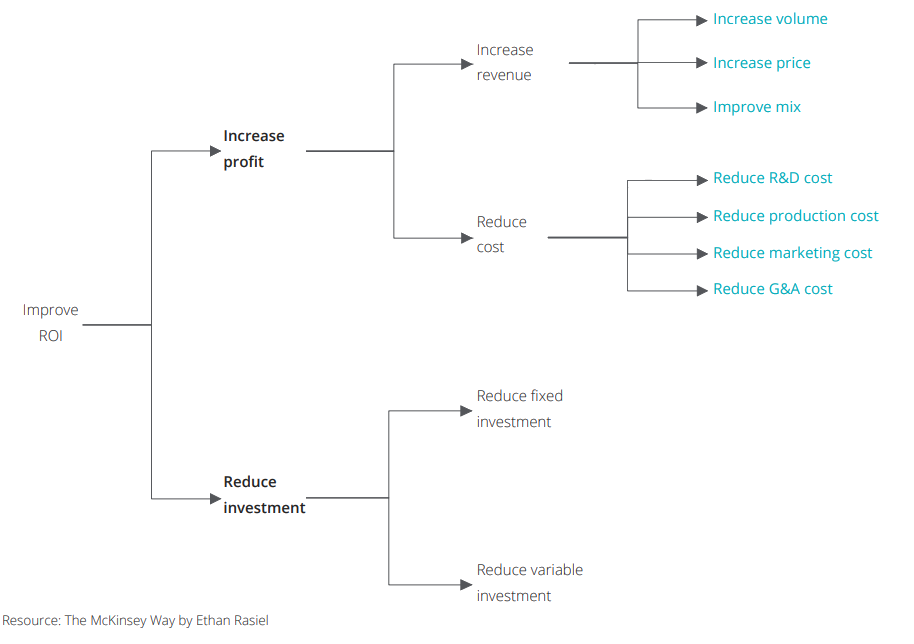

The MECE framework helps in problem solving by allowing you to separate the problem into distinct, nonoverlapping issues. It ensures that no issues relevant to the problem are overlooked. According to Ethan Rasiel, author of “The McKinsey Way,” a list of major issues using the MECE framework should contain no fewer than two major issues and no more than five major issues. This acts as a broad indicator for a consultant on how to categorize information. Using MECE, you can create a logic or issue tree that breaks down a problem into components.

There should be no overlap in categories (mutually exclusive) and all the categories together should cover all possible options (collectively exhaustive).

Final thoughts

The frameworks in this guide are valuable additions to your toolkit. Instead of spending time on developing an approach, they offer a starting point for analyzing business problems—whether for your client or for your solo consultancy. Frameworks can help structure your questioning and information-gathering process. However, remember not to force your analysis into these frameworks. They are simply tools to support you and the future of your company.

Download our frameworks worksheets to determine the best framework for your business.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.