How to Write a Consulting Contract (Guide): Types and Terms to Include

The modern independent consultant must adapt to their surroundings, especially when client organizations change rapidly. Consulting agreements can be as simple as a single page or a lengthy, detailed document, but what matters most is that a legal framework is established and signed by both parties to cover a worst-case scenario.

GATE

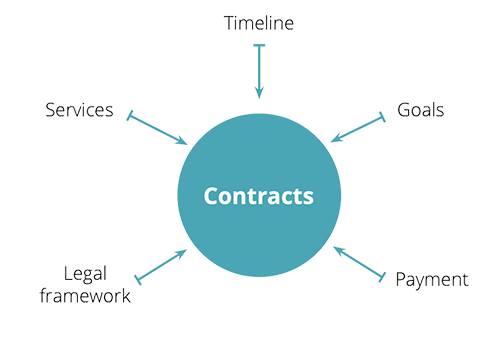

Contracts establish non-employee relationships with clients, protecting both parties and providing a strong foundation for the independent and client. Organizations need these protections to avoid misclassifying workers and facing associated penalties. Independents require the validation provided in a contract to confirm the relationship with the client.

Contracts ensure respective expectations are documented, clearly outlining the services to be performed, the timeline for completion, and payment terms and conditions. This guide will explore the types of contracts and agreements one that independent contractors may encounter, providing a glossary of key terms and sample agreements. It has been designed to build the confidence and knowledge necessary to successfully negotiate consulting agreements.

5 Types Of Contracts

You may encounter many types of contracts and agreements in your solo business, including Master Services Agreements, Independent Contractor Agreements, and Memorandums of Understanding. This section explores these different contracts and agreements.

- Independent Contractor Agreement

- Memorandum of Understanding

- Master Service Agreement

- Letter of Agreement or Engagement

- Scope of Work

Independent Contractor Agreement

An independent contractor agreement outlines the terms and conditions between your business (as an independent consultant, contractor, freelancer, or small firm) and your client. The agreements are governed by the laws of the selected state, and may include confidentiality, non-disclosure, and non-compete clauses. These contracts are flexible and can be used for almost any type of service.

Memorandum of Understanding

A memorandum of agreement (MOU) or cooperative agreement is a document between parties to cooperatively work together on an agreed-upon project or meet an agreed-upon objective. The purpose of an MOU is to have a written understanding of the agreement between parties. The MOU can also be a legal document that is binding and holds the parties responsible for their commitment.

Master Services Agreement

A Master Services Agreement (MSA) is a contract that spells out most, but not all, of the terms between the signing parties. An MSA will usually include payment terms, delivery requirements, intellectual property rights, warranties, limitations, dispute resolutions, confidentiality, and work standards. The purpose of an MSA is to expedite and simplify the administration of future contracts. This enables you to do the initial negotiating at the beginning, ensuring that future agreements only need to outline the differences from the original contract and may only require a purchase order.

The MSA will also identify how risk is divided among all signatories if any party is sued by an outside entity. It may specify whether all parties share responsibility for attorney fees or if everyone must agree to alternative dispute resolution methods. MSAs are common in information technology, union negotiations, government contracts, and long-term client/ vendor relationships. They can impact a wide area, such as a country or a state, with subset terms negotiated at the local level.

An MSA Contains:

- Payment terms

- Delivery requirements

- Intellectual property rights

- Warranties

- Limitations

- Dispute resolutions

- Confidentiality agreements

- Work standards

MSAs are common in information technology, union negotiations, government contracts, and long-term client/vendor relationships. They can impact a wide jurisdiction, such as a country or a state, with subset terms negotiated at the local level.

Letter of Agreement or Engagement

Another alternative to a formal MOU or MOA is a Letter of Agreement or Engagement. These are frequently used in lieu of a more formal contract. Once accepted and signed, it becomes a formal contract, and both parties are bound by it. Engagement letters are traditionally used by certain professional service firms—particularly in the fields of finance, accounting, law, and consulting—to define the specifics of the business relationship. Normally, the service firm sends an engagement letter to an officer of the engaging company. Once the officer has signed the letter, the letter serves as a contract.

Scope of Work

This document is an addendum to a contract or letter of agreement. It defines the work to be performed for a project, typically broken out into specific tasks with deadlines.

Letters of Agreement can vary widely in the amount of detail and specificity included, but may outline details such as:

- Project summary, including any conditions or results you and the client have discussed

- Critical dates (project start date and completion date, invoice submission, payment due)

- Agreed-upon payment

To learn more about the critical components to creating an SOW document, download our SOW Template

Key Contract Terms

| Arbitration: | A legal technique for the resolution of disputes outside the courts. |

| Breach: | A situation in which one or more parties to the contract do not honor a binding agreement. |

| Indemnification Agreements: | Indemnification Agreements: Agreements that typically guarantee against any loss which another might suffer; one or both parties commit to compensate the other (or each other) for any harm, liability, or loss during the performance of the contract. Vary widely. |

| Injunction: | An equitable remedy in the form of a court order, whereby a party is required to do, or to refrain from doing, certain acts. |

| Intellectual Property (IP): | Intangible rights protecting the products of human intelligence and creation. IP might include inventions or patentable information, but it can also include sales or price history, computer codes, or other information. Business-to business agreements often contain agreements governing ownership or use of IP. |

| Jurisdiction: | The geographic area over which authority extends, legal authority or the authority to hear and determine causes of action. |

| Non-Compete / Exclusivity: | A term under which one party agrees to not pursue a similar profession or trade in competition against another party. These are sometimes referred to as Non-Solicitation Agreements, which typically restrict the ability of an exagent (whether an employee or business) to solicit clients or emp |

| Non-Disclosure / Confidentiality: | A contract through which the parties agree not to disclose certain information covered by the agreement. Non-Disclosure may be a covenant included in the standard contract or a separate document, a Non-Disclosure Agreement (NDA). Some clients may require a signed NDA before exchanging detailed information about the project. |

| Term: | In contracts, a fixed period of time in which the contract is in force. |

| Warranty: | An assurance by one party to the other party that certain facts or conditions are true or will happen. |

Contract Restrictions to Avoid

There are various ways to draft a legal agreement, but standard covenants and clauses can become burdensome and even pose risks for independent consultants, depending on the language in the contract. Below are a few key considerations that deserve your attention:

The Independent Contractor shall not, without the prior written consent of the Company, provide Service “X” to any Customer of the Company that Independent Contractor had contact with on behalf of the Company during the preceding twelve (12) months.

Non-compete: The language of a non-compete can severely limit your ability to work. Some clauses may limit you to certain geographic areas or prohibit you from working within your area of expertise. A non-compete agreement typically imposes restrictions of three types:

- Time: A non-compete restricts someone from opening a competing business within a certain time period.

- Distance: A non-compete also prohibits opening a competing business within a certain distance from the original business.

- Type of business: Non-competes restrict businesses of similar types from competing with former businesses.

Make your best effort to limit (or eliminate) the language of a noncompete to indicate that you will not steal your client’s business.

Indemnity

Overbroad “indemnity” clauses can require you to indemnify against anything that happens under the terms of the contract. These clauses can also be one-sided, requiring you to indemnify the client only.

If possible, try to limit the scope of the indemnity and ask for mutual indemnification. Many companies are not willing to sign indemnification agreements, even if indemnification is mutual.

Indemnity (n.): Security or protection against a loss or other financial burden.

Example: Consultant shall indemnify and hold harmless XYZ and its respective affiliates from and against all claims, cost, liabilities, judgments, expenses, or damages owed to third parties (including amounts paid in settlement and reasonable attorneys’ fees) (collectively, “Losses”) arising out of or in connection with (i) Consultant’s breach (or alleged breach) of any covenants, warranties or representations made herein or (ii) with respect to any Third Party Materials.

Burdensome Warranties

The wording of warranty covenants can be overly broad and require you to take on great risk. Be careful with accepting a warranty that is not defined by time or is not reasonably achievable. You should strive to warrant only those things that are within your own resources or control and that you reasonably believe you can deliver.

Example: Deliverables, if applicable, will be free of bugs, viruses, defects, design flaws, or any disabling code or other devices that may cause the Deliverables or any portion thereof to become erased or inoperable or incapable of performing as intended or affect the operations of other systems; (f) for a period of six (6) months following the launch thereof, the Deliverables will be (i) free from defects in material and workmanship under normal use and (ii) will function as intended in accordance with the Specifications; and (g) Consultant will, in performing its obligations hereunder, strictly comply with all applicable laws.

Key contract language considerations:

- Non-compete agreements

- Indemnity

- Burdensome warranties

- Terminations

- Reviews

- Payment terms

- Ownership of work

- Exclusivity

- Insurance requirements

- Undisclosed flow-downs from prime contracts

- Liens and bonds

- Administrative

Termination and Reviews

Client-provided contracts may have a one-way termination provision, which permits the client to terminate the relationship at any time without offering you the same option to end the agreement. Try to negotiate some mutual ability to terminate the contract in a certain period of time. It’s often fair and reasonable to provide a time period for notice of termination. The length of a termination notice period depends on many factors, including how long it would reasonably take your client to find a substitute for the services provided by your business.

Reviews: Client-provided contracts may include hidden costs or warranties that allow clients to withhold money and charge you for an audit. In some cases, such clauses may be reasonable; however, in other cases the clause may be overly burdensome. Negotiate to have this language removed as appropriate.

Example: XYZ shall have the right to terminate this Agreement or any Statement of Work for its convenience at any time by providing thirty (30) days prior written notice to Consultant.

Example: Consultant will reimburse XYZ for any expenses incurred by XYZ in connection with any audit, which results in the correction of a billing error by Consultant in an amount greater that 5% of the charges that were subject to such audit for the period audited.

Payment Terms

Look for anything that will impact your ability to be paid, including invoicing, billing, and time keeping policies. Some contracts may also have payment terms that do not align with your policies, i.e., a 60-day term when your standard term is 30 days.

Know Your Payment Terms

Defining net terms

Make sure payment is due within 30 days of receipt of invoice. Spell out the timeframe for payment clearly.

Up-front payment

In some agreements, you may require some payment before beginning work. For example, in a retainer agreement you may require the first month’s billing up front. Clearly spell out any requirements for a deposit or up-front payment.

Frequency of invoicing

Discuss how and when you will invoice the client. For example, you may choose monthly electronic billing or to bill on the same day each month. Review invoices carefully and negotiate accordingly. Also consider anything that places additional burdens on your time, such as a requirement to log your hours in three different systems. These burdens can be a drain on your time, adding to the cost of the contract. The MBO Partners resource center provides more information on how to prepare and present professional invoices.

You can also use payment terms to offer your clients benefits such as:

- Refunds or discounts. Define provision for refunds or discounts in the payment terms. MBO Partners’ blog offers helpful insights regarding whether one should offer discounts to your clients.

- If you offer a trial period, specify the timeframe and criteria for assessment so clients know they can review your work and terminate the arrangement if it doesn’t meet their expectations.

Ownership of Work

If you are engaged to create intellectual property, it’s common for your client to require that they own your creation. Clients might opt for partial ownership of your creations, acquiring a license or usage rights that could be either exclusive or non-exclusive.

In any case, the person or entity who will ultimately own your work product is an important term within your contract. This term should be reviewed carefully and verified for accuracy. If you are bringing your own intellectual property (IP) to a project, it may be appropriate to protect it by having it specifically identified or removed from any IP assignment language in the contract.

Example: Unless otherwise expressly indicated in a Statement of Work, Consultant shall submit, at least monthly, statements for Services rendered and expenses incurred in such form and detail as XYZ shall require, by the 15th day of the following month.

For example, if you use any third-party licenses, make sure you comply with the terms of those licenses. You may want to have your agreement define who will be responsible for their maintenance.

To the extent that any materials owned by or licensed from third parties (the “Third Party Materials”) are included in the Deliverables, Consultant shall obtain for XYZ, at Consultant’s sole cost and expense, a perpetual, irrevocable, worldwide license to (i) use, reproduce, distribute, publicly perform, publicly display, modify, and prepare derivative works of such Third Party Materials and (ii) sublicense any of the foregoing rights.

Example: All Work Product and Deliverables are and shall be considered a work made for hire for XYZ as such term is defined in Section 101 of the Copyright Act of 1976, as amended, and that as such XYZ owns and shall continue to own all right, title and interest in and to the Work Product and Deliverables.

Independent consultants and small business owners who oppose the use of written contracts may claim to do so for a variety of reasons, but the reality is that contracts are simply a written record of the agreement between consultant and client. Read more on the MBO Partners blog.

Exclusivity

An exclusivity covenant is a different type of “non-compete” arrangement, which typically restricts you from entering into a similar agreement or a particular business activity with other parties for a specified period of time.

While you should be willing to provide fair protection for your clients, be sure to watch out for limitations and how they will impact your engagement. Also, try to retain a reasonable ability to work within a community/space without giving up all your rights.

Insurance requirements

Most large companies require their vendors to carry an expensive general liability policy, which can be upward of $1 million or even higher in some cases. It’s a good idea to have this type of insurance, and you should expect that some of your clients will have insurance requirements in their contracts. In some industries and circumstances—such as those involving professional service providers, vendors, and users of public property—insurance requirements are standard. Contact an insurance provider and give them the specific language in the contract. They can usually provide the policy for you at a reasonable cost.

Example: Consultant shall not, during the period in which this Agreement is in effect, provide similar or like Services on behalf of any other entity which is an actual or prospective competitor of XYZ, including companies or entities in the business of providing _____ services.

However, some client-provided contracts may have additional insurance requirements. Worker’s compensation insurance is not always required by state law, but your client may require it. Clients may be attempting to limit their liability and protect against misclassification. Clients may also require Errors and Omissions (E&O) insurance, which serves as a type of professional liability or malpractice insurance.

E&O insurance can be costly, so it’s important to review these provisions carefully. While it’s often fair and reasonable for your clients to require insurance, a “standard” contract may include insurance terms that don’t apply to your situation.

Keep in mind that you may not be able to negotiate the contract as much as you like—some of your clients may consider the terms non-negotiable—so make sure you read the entire document and make sure you can comply with it.

Consider working with an independent worker business operating system or service provider (MBO Partners is just one example) that can bundle these expensive insurances into their overall program fees, offering hassle-free coverage along with other business benefits.

Other Provisions and Contract Oddities

| Undisclosed flow-downs from prime contracts: | Administrative constraints: | Liens and bonds: |

| Administrative constraints: Administrative constraints: Liens and bonds: A flow-down clause, also called passthrough or conduit clause, obligates a contractor to include certain language (as defined in that clause) to be incorporated in contracts with subcontractors. You may see this in a Master Service Provider Agreement or government contract. These clauses can be buried in a contract and will refer you to another prime contract or federal document. These clauses may also require that you insert a similar flow-down clause in contracts that you enter into with your own subcontractors. Terms may also not be reciprocal and hold you liable for all rights and responsibilities of the prime contract. Be careful of this language. You should always ask to see the prime contract provisions that are referred to in your contract. The example is from the Federal Acquisition Regulations System, FAR 52.215-12. | Some contracts may have burdensome administrative constraints and may require a significant amount of time. Watch out for these provisions and try to negotiate them out or limit them to a manageable scope. Client-provided contracts may also include language that doesn’t apply to you, such as on-site drug testing, inventions, or patent language. Ask the client to remove this language, if possible and where appropriate. If the language is not potentially damaging, you may concede as part of the negotiation to leave the language in the agreement. Focus your negotiation on the most important clauses for your particular situation. | You may encounter language that places a lien or bond against your property, or assets under certain conditions. This can be rather complex if your client will not negotiate the language out and may require advice from a legal provider. |

There are many ways to word a legal agreement. However, standard clauses and terms can become burdensome, even risky.

Contract Negotiation Tips

Negotiations play an essential role in finalizing any contract. The goal of negotiations is to get a mutual win so that both you and the client establish a good working relationship and are legally protected. In larger organizations, you may negotiate with the procurement department or a contract manager. In smaller organizations, you could be working with a staffing or recruitment representative. If the client representative is less than friendly, keep it professional and stick to the negotiating points.

Prior to your negotiation, go through the contract and make your notes—but have a clear bottom line in mind beforehand. Don’t assume anything; your client might be more flexible on certain terms than you realize. In other cases, your client may not be willing to change something that you think they should concede. Not all your proposed changes will be accepted, so it’s important to identify what you can and cannot accept.

Think of negotiating a contract as a dialogue rather than a battle of wills. The ultimate goal for both you and your client is to clearly outline expectations and mitigate risks. Keeping this in mind can help you navigate negotiations with less stress and help you to stay focused on the end goal.

Sample Agreements

Sample Independent Contractor Agreement

Please click here to view a sample Independent Contractor Agreement

Sample Consulting Agreement

Please click here to view a sample Consulting Agreement

Sample Consulting Contract with Concerns Highlighted

Click here to view an example of a generic sample consulting contract that highlights in yellow all areas that may be concerns for an IC going into business with a new client.

These are not necessarily contracts that you want to use – they are illustrations to show typical areas that you may want to review with extra care.

You should review future and recent contracts you have received or signed and see if you have the ability to change or prevent future issues with terms that might do more harm than benefit.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.