Scope of Work Essentials: Overview, Best Practices, and Helpful Templates

Much like a contract, a scope of work is a foundational document for any independent consultant–client relationship. Use this step-by-step guide to create a Scope of Work document that outlines the essential details of your project with a new client, including key terms and general descriptions.

GATE

What Is a Scope of Work Document?

Before starting a new project, independent workers are often asked to prepare a Scope of Work document for a client that outlines the terms of their project and details items such as expected timelines and payment terms. Much like a contract, a scope of work is a foundational document for any Independent–client relationship. If you’re creating one for the first time, the structure and importance of a Scope of Work, or SOW for short, can be intimidating.

This guide will offer you a step-by-step guide to creating a document that outlines the basic details of your project with a client, including key terms such as payments, revisions, and timelines.

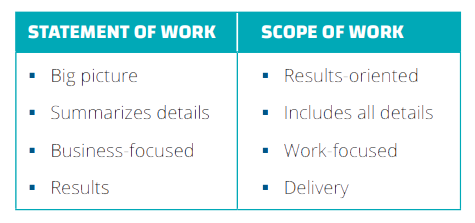

While the terms “Scope of Work” and “Statement of Work” are often used interchangeably, the two terms mean different things.

Why You Need a Scope of Work

The scope of work articulates the details of a project including expected tasks, materials and equipment (if appropriate), deliverables, and expected timelines. It sets clear expectations upfront and serves as a guiding post to keep both you and the client on track.

To understand the importance of a detailed SOW, let’s pretend you are hiring a consultant to develop a mobile app. A well detailed Scope of Work defines what the final product should accomplish, then breaks down specifics such as the development platform (Ruby, Python, etc.); the design; user interactions; key features and components; and the overall costs

If the SOW isn’t detailed enough and simply says “consultant to build an app accomplishing X or Y task,” the resulting “gray area” leaves room for the consultant to build a product that doesn’t integrate with a client’s existing systems, fails to match design criteria, or misses key steps in the user flow. Cost could also become a factor if the client demands extra rounds of revisions or makes requests for ongoing maintenance and development not detailed in the initial scope.

The SOW’s main job is to take a client’s vision and break it into concrete details. Precision is key in any SOW, as ambiguity can lead to issues during a project.

Keep in mind that a Scope of Work becomes part of a contractual obligation to a client. This makes it even more important to clearly articulate every detail of the project.

GOAL: ELIMINATE FRUSTRATION

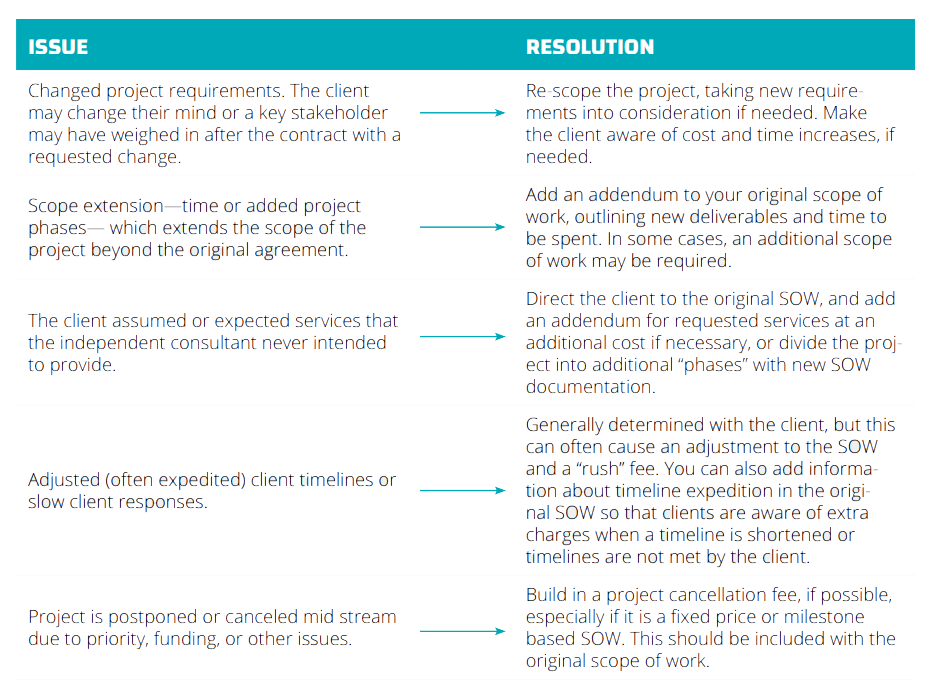

One of the main goals of the SOW is to prevent frustration between consultant and client bysetting clear expectations for deliverables, costs, and timelines. Some clients are notorious for “scope creep,” meaning that they add on new requests and requirements not set forth in the original scope of work.

Scope creep (n.): To add new provisions, tasks, or expected deliverables that are outside an existing scope of work.

Work that falls outside the Scope of Work can lead to frustration for both the consultant and the client. It may strain the business relationship and impede the progress of the original project. But while the SOW should be clear and detailed, it’s wise to not make it too restrictive. Projects rarely go exactly as expected, and building flexibility into the scope allows you to adapt to internal or external changes.

Communication is key

The SOW is a communication tool: Use it to discuss and agree upon objectives and expectations. Develop this document at the very beginning of a client engagement and share it in your initial client meeting to manage expectations and define a project plan. It can also be used as a point of negotiation during the buying phase.

If the client wants to negotiate price, you can adjust the Scope of Work, rather than your fee, to fit a client budget. Of note, adjusting the scope rather than the fee also creates an opportunity to provide a phased-in approach. For example, a consultant can break down a larger SOW into multiple projects that can be implemented over time.

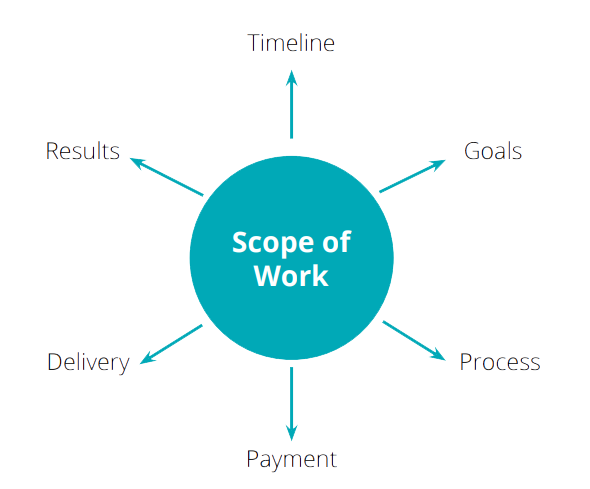

What Is Included in a Scope of Work?

As anyone experienced in the request for proposal (RFP) process knows, an SOW is typically included in the requirements. From the client side, an SOW is used to communicate the goals and expected results of the project and ensure that key issues are not overlooked. Because this document is often requested before a project is awarded, there is some difference between a proposal Scope and a finalized Scope—often the latter is a revision of the documentation provided during the initial proposal.

Also of note: Scopes often vary widely by industry and by client. Some clients, such as government entities and universities, may have very specific requirements for an SOW.

In general, here are the items you should outline in your Scope of Work:

- The purpose of the project. Often part of the introduction to your Scope of Work, this brief statement or paragraph explains the reason for the work.

- Work that will be performed. Are you being hired to build a new website, launch a new product, or train a team? Outline the work that you will do and include the specific tasks and activities that will be performed to deliver the final output.

- Work that will not be performed. It can also be helpful to outline a negative or excluded scope of work—work that is not included as part of the contract. For example, a web designer may exclude ongoing web maintenance as part of the scope.

- Process for change orders. During the course of your engagement, the client’s needs may expand or change, or you may encounter unexpected challenges. Including an agreed-upon process for changing the scope and fees can streamline your workflow and prevent unnecessary delays during the project or engagement.

- Roles and responsibilities (you and client). Outlining the roles and responsibilities will help keep everyone accountable and eliminate potential confusion.

- Timeline for work. When will the work start? How long is it expected to last? Is this a fixed-time project or long-term engagement? Are there milestones?

- Performance measurement. How will you measure progress? Are there specific metrics that will define success in the client’s view? This section of the SOW will help define the expected result of the project and how results are communicated.

- Payment terms. Include the total budget amount along with the timing of payments. Are you on a monthly budget? Is there an upfront payment and subsequent milestone payments? Are payments tied to specific tasks?

The SOW will be customized based on your engagement, client, and industry.

For example, a technology SOW may be comprehensive, covering equipment, testing, and detailed milestones. On the other hand, a level-of-effort SOW might focus on delivering a set number of hours and not require the level of detail. You might also have a performance-based SOW, where you have flexibility in how you meet the client’s objectives.

Your dedicated business manager at MBO Partners is happy to help review contracts, SOWs and more as part of your engagement. We can offer advice to help limit “scope creep,” negotiate optimal payment terms on your behalf, and more.

Writing contractor-friendly RFPs isn’t as difficult as it looks. This article walks you step-by-step through the ideal RFP.

Scope of Work Tips and Strategies

Before you can write a great SOW, you need to ensure that you have a clear understanding of the project from your client. Here are some questions to consider:

- What problem or issue will the project address?

- Is the problem or issue confined to a specific business unit or department?

- Who are the stakeholders?

- What specific services will be required?

- What resources will you need to provide your client?

- Are there tools or resources that the client must provide in order to complete the project?

- How must the project be delivered? For example, this may specify deliverables such as digital versus physical copy or set milestones with different phases of the project to be completed within designated time frames.

- How will progress be communicated?

- What is the final result?

- How will success be measured?

- How and when will payment be distributed?

Your SOW should be error free and easy to read. Additionally, be mindful of any terms that might have legal implications

As in general business writing, refrain from using abbreviations and acronyms. Do not assume that these terms are universally understood or used. If abbreviations or acronyms are necessary, be sure to define them. Also, it’s tempting to use the passive voice. For example, “Writing services shall be provided to Company Y,” rather than “Company X will provide writing services to Company Y.” However, the active voice does a better job of clearly outlining tasks and responsibilities.

Try to be consistent throughout the document. For example, if a scope of work includes public relations, avoid alternating between “PR” and “public relations” and use the same term to describe the same concept throughout the document.

When writing a scope, be direct and specific, clearly describing the services to be performed and the deliverables expected. Never assume that the client will know what is intended—state it in clear language.

A well-crafted Scope of Work lays the foundation for a successful project. It provides the tools to effectively plan and manage a client project, ultimately fostering lasting client relationships. We hope this guide helps you feel better prepared to manage your client projects.

One of the most essential skills for any solopreneur to have is the ability to negotiate business deals. The way in which independent contractors negotiate can make or break their business. If handled correctly, negotiations can solidify relationships with clients, strengthen connections with vendors, and help you to grow your business.

Scope of Work Template

Here’s a list of what to include in your Scope of Work:

- Project overview. Write a brief, high-level overview of the project.

- Scope overview. Describe the overall scope of work.

- Objectives. What are the client’s specific objectives for the project? How will the SOW align with these objectives? Clearly define the results or outcomes the client wants to achieve.

- Activities/tasks. The specific activities and tasks need to be defined in a series of actionable steps.

- Deliverables. What are the results or outputs to be accomplished at defined time periods and/or at the end of the project? For example, an architecture consultant hired on a building project may be required to deliver blueprints at the end of the first month one and a model to scale after three months. Specify the work product and method of delivery.

- Inclusions/exclusions. The SOW should outline the essential work included as part of the project. If it’s not specified, it’s outside of the scope. As discussed earlier, you can also add a negative scope of work. This is a smart idea for services that may often be assumed to automatically be included. For example, if you are hired to install software and training is not included, you may want to note this in the scope of the project.

- Schedule/timeline. Define the time period of the project. What is the project’s start and end date? Are there deliverable milestones?

- Payment. Specify the project budget and timing of payments. Will you receive an initial payment to start the project and subsequent payments at fixed time periods? Are payments tied to specific deliverables?

- Performance measurement. What metrics will be used to measure performance? Be clear on what will be measured and what will determine success according to the client’s standards.

- Reporting and communication. Specify how and how often progress will be reported. Will you provide weekly written reports or hold monthly meetings? Does the client have any special reporting requirements, i.e. using a specific form or entering information into a database?

Want some extra help? Use our template! We created a sample version that you can download. Use it as an aid to create your first SOW or as a review tool for your existing scope document.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.