4 Ways to Get Your Small Business Ready For Tax Season

- Even with the extended deadline, you might want to consider filing your taxes by the initial April 15 deadline if you can.

- Tax season doesn't have to be something you dread, whether you do it on your own or employ a tax preparation professional.

- To prepare your small company for tax season this year, follow these four steps.

This tax filing and payment relief also extends to estimated tax payments for 2020 that would typically be due on April 15.

Even with the extended deadline, you may want to consider at minimum filling your taxes by the original April 15 deadline if you are able to do so. Because the income tax refund schedule has not changed, you will get your refund the sooner you are able to file.

Be sure to keep in mind that this relief may not apply to filing deadlines for your state taxes. You can review specific rules for your state at the Federation of Tax Administrators’ website. If needed, you can delay filling taxes by filing an extension—Form 4868 for individual and Form 7004 for businesses.

Whether you go it alone or hire a tax preparation professional, tax season doesn’t have to be something you dread. So long as you prepare your documents, take the proper steps, and compile the information you need, your annual tax filing will be simple and painless. Follow these four steps to get your small business ready for tax season this year.

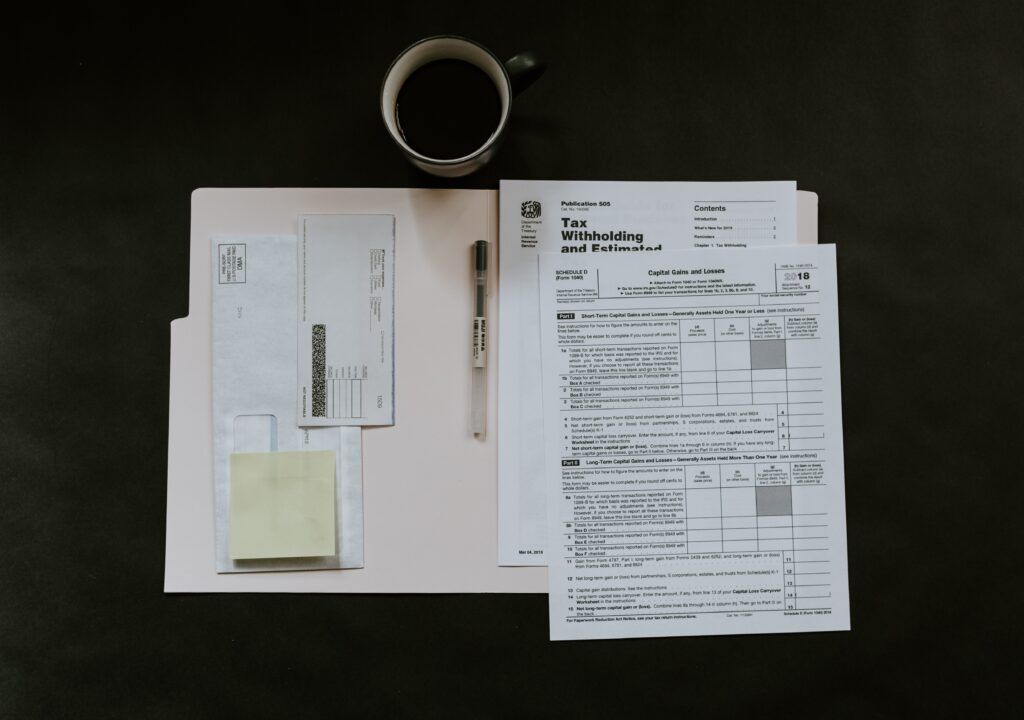

1. Get Paperwork Together

Whether you’re doing your own taxes or having them prepared by a professional, it’s important to make sure you have all the information you, or they, will need. When the deadline for filing annual taxes approaches, the last thing you want to be doing is scrambling to get all of your financial data together. Or worse, filing with inaccurate information which could end in potential fines, penalties, or prosecution.

Ideally, the majority of the information you’ll need—records of expenses and documentation of all income—is already consolidated in your accounting system, be that an outside accountant or your own billing or accounting software. You should also make sure that you have access to the documents that show your income and expenses, ideally in both paper and digital form. Should you get audited, having thorough documentation will be invaluable.

At the very minimum, make sure you have the following documentation:

- Records of all income, including 1099s received from clients

- Receipts for business-related expenses

- Past tax information, including your quarterly filing paperwork

2. Know What You’re Responsible For

Income tax may not be the only tax you are responsible for, so it’s important to understand other possible tax requirements you may face. The majority of independent contractors are considered to be self-employed and are therefore subject to paying self-employment tax in addition to income tax.

However, there are situations and circumstances in which this tax may not apply to you. For instance, how your business is incorporated may affect your obligation regarding this tax. In addition, whether or not your business made a significant profit during the past year could also be a factor. More information about self-employment tax requirements can be found on the IRS website.

3. Compile Proper Forms and Documents

In addition to affecting your eligibility for things like self-employment tax, the legal status of your business also determines the forms you need to file with the IRS. Filing the wrong forms could cause delays that result in penalties and fines, or, at the very least, extra hassle and wasted time. While the exact forms you need will vary depending on factors such as your income, the structure of your business, and state laws, two common forms you’ll need for federal income tax filing are:

- Schedule C (Profit or Loss from Business—Sole Proprietorship)

- Schedule SE (Self-Employment Tax)

If your business is structured as a partnership, LLC, or another form of business, different tax forms may apply to you. You can learn more about the forms applicable to various business types on the IRS website.

4. Take the Right Deductions

As an independent contractor, you can deduct additional business-related expenses to lower your tax liability. As you prepare for tax season, research and keep in mind various deductions you may be eligible for along with records and receipts of all expenses you plan to deduct. A few categories of potential deductions include:

- Home Office: If you work from a dedicated office space in your home, some of the costs associated with that space, such as partial utilities, may be deductible.

- Office Supplies: from home office hardware to business-specific furniture, your office supplies may also qualify as an additional deduction.

- Health Insurance: If your consultancy’s business structure means you have self-employment income, you may be able to deduct a percentage of your health insurance premiums for yourself and your dependents.

More information on business-related tax deductions can be found on the IRS website.

The information provided in the MBO Blog does not constitute legal, tax or financial advice. It does not take into account your particular circumstances, objectives, legal and financial situation or needs. Before acting on any information in the MBO Blog you should consider the appropriateness of the information for your situation in consultation with a professional advisor of your choosing.

Categories

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.