Gross vs Net Income: Differences and How to Calculate

- Gross income and net income are easy terms to confuse.

- Gross income is the total amount you earn (typically over the course of a year) before expenses.

- Net income is the profit your business earns after expenses and allowable deductions.

- Gross income and net income can provide a different perspective and affect goals and actions you may take personally or as a business owner.

The terms gross income and net income can be easily confused. Per definition, gross income is the total amount you earn, and net income is actual business profit after expenses and allowable deductions are taken out. However, because gross income is used to calculate net income, it’s important to understand how each is calculated.

When you run your own business, understanding the difference between gross income and net income is important both to evaluate your financial status on a personal level as well as to assess how your business is doing. These numbers can also have a big impact on how you pay taxes. By understanding how gross income and net income are defined, you can better understand their key differences.

What is gross income?

Definition: Gross income is the total amount you earn (typically over the course of a year) before expenses. Think of it as the profit you’ve made from the services you provide—the sum of all your client billings before any deductions, taxes, or withholding.

How to calculate: To calculate your annual gross income, add up your total client billings for the past year. For example, if your client billings add up to $90,000 in revenue, that number is your annual gross income or total gross wages.

Why is gross income important?

Gross income is a helpful way to look at the revenue potential of your business and to assess how you are doing year over year. By looking at your various revenue streams, you can see which clients and which types of projects bring in the most income and the least income. This insight may influence where you choose to direct the majority of your time and effort, or determine the future goals you set for your business.

What is net income?

Definition: Net income is the profit your business earns after expenses and allowable deductions.

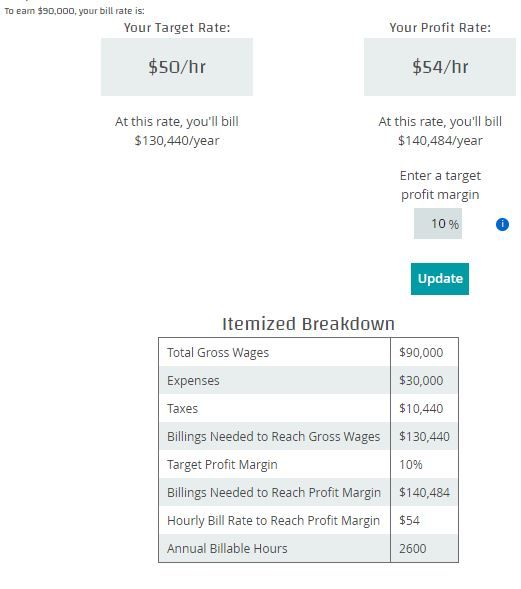

How to calculate: To calculate net income, take your gross income and subtract all of your business expenses—marketing or advertising costs, travel or office expenses, tax payments, etc.—as well as any deductions you may be eligible for such as a home office space, retirement plan, or legal and professional fees. Below we have used our bill rate calculator to calculate an example of typical business expenses so that net income can be determined.

After you determine your expenses, you can calculate your net income vs gross income. Using the above expenses in our bill rate calculator, here is the calculation that determines your gross income as $90,000 less your expenses of $30,000, making your net income $60,000.

Why is net income important?

Net income can help you understand the health of your business. For instance, if your gross income is significantly higher than your net income year after year, you may want to evaluate your expenses line-by-line to see what you can eliminate or reevaluate.

Gross vs net income: Why understanding the difference is important

Knowing your gross and net income is an important part of managing your finances on a personal level and managing a successful business if you are a small business owner or self-employed. It can also help you make important decisions about income choices, such as when to raise your rates, whether or not certain expenses are necessary, and the types of income, projects and clients that you should be focusing on.

Gross income and net income can provide a different perspective and affect goals and actions you may take personally or as a business owner. For example, as a business, gross income can indicate the revenue generated year over year and provide a perspective on how your business is doing. It is useful in tracking trends and seasonality of sales. However, while gross income will indicate sales effectiveness, it will not indicate whether your business actually made or lost money.

Net income will tell you a slightly different picture – how much you are making after expenses are factored into the equation. Net income will show you how much money your business is making or losing over a given period of time. While net income will not indicate whether sales are getting better or worse, if your net income is lower than expected, there are certain actions you can take, such as cutting expenses and other cost saving measures.

To learn how to calculate your net income based on expenses and allowable deductions, try our calculator.

Categories

Subscribe to the Insights blog to get weekly insights on the next way of working

Join our marketplace to search for consulting projects with top companies

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.