Worker Classification Guide: 3 Options for Engagement

The independent workforce is a growing and increasingly valuable source of talent. In fact, over half of executives say that leveraging an external workforce enables them to improve the overall financial performance of their company and helps balance business costs (The Contingent Labor Imperative).

However, outdated or inefficient practices for engaging independent contractors can increase costs, alienate key talent, and expose companies to risk. Understanding the direct and indirect factors associated with various engagement methods can help you develop smarter strategies to gain a competitive advantage in today’s project-based economy.

GATE

What Qualifies a Worker As Self-Employed or an Independent?

Workers may consider themselves self-employed when they generate income as a freelancer or proprietor of their own business. These workers have many names, from consultant and 1099 to independent contractor. While the words may “mean” the same thing to many, from a legal standpoint, they are not all the same. This nuance is important to ensure correct classification, and why many enterprises choose to outsource this work to a professional firm such as MBO Partners that indemnifies against costly misclassification risk.

In order to be classified as an independent contractor, there are numerous legal qualifications that workers must meet. Operating as a business rather than an employee, work is provided according to a contract; the worker supplies their own equipment and is responsible for both individual and employer taxes are just some of the many state and federal factors that a worker must meet to qualify as an IC.

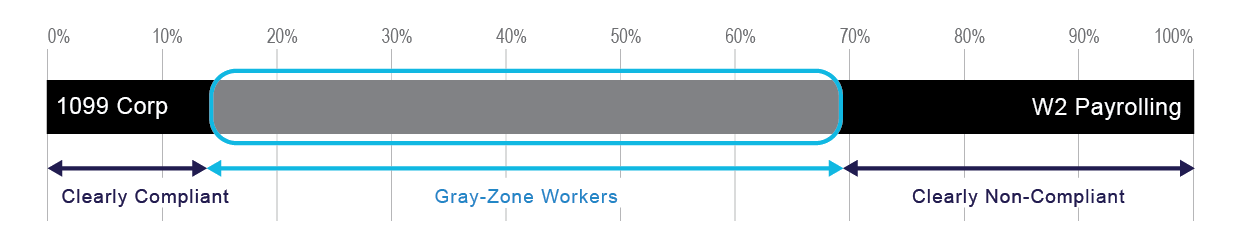

We have found that in addition to differing levels of self-employability, workers have credible individual preferences and requirements. Some are clearly compliant and may immediately qualify to work as a 1099 independent contractor; others are clearly non-compliant and prefer standard W-2 employment status.

A significant segment falls into the middle of the spectrum — we refer to these independent professionals as gray zone workers. This group sees themselves as independent professionals, yet they may be missing one or two provisions that prohibit them from being classified as an independent contractor for the business requirements of their prospective employer or for the state in which they are working.

For example, they may not have an active professional website or meet certain business insurance requirements. In our experience working with over hundreds of large enterprises in nearly 30 years of business, less than 40% of self-employable talent qualify as a 1099 contractor on their own.

Gray Zone Engagement Explained

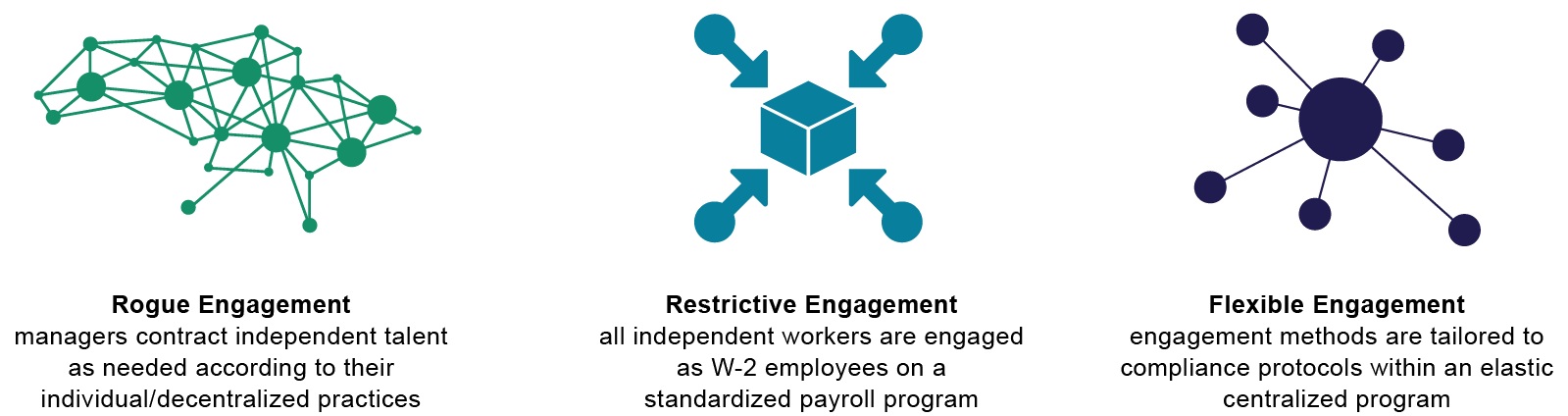

Gray zone engagement historically falls into one of two categories: Rogue or Restrictive. Rogue engagement opens organizations to risk, while Restrictive Engagement, typically preferred by legal and procurement leaders, is often not talent-friendly and causes friction internally and externally.

MBO is unique among engagement providers in that we offer a Flexible Engagement framework that puts compliance at the fore while ensuring a talent-first approach:

1. Rogue engagement

- Increased misclassification risk:

- Managers engage workers as independent contractors even though they may not be fully qualified;

- If an enterprise is found guilty of misclassification, they may be liable for paying back taxes, benefits, or penalties to misclassified workers, in addition to working through lawsuits or dealing with reputational damage costs

- High administrative costs:

- Independent workers are not managed strategically or consistently as a category within the enterprise creating an administrative burden;

- Accurate ROI attribution is therefore difficult to achieve and actual spend difficult to calculate

2. Restrictive engagement

- Increases program costs, primarily because payroll markups range from 20-50%

- Deters independent professionals who do not want to be engaged this way; highly skilled and in-demand workers often to look for ways to circumvent this classification or take their skills elsewhere

- If managers sidestep this program to attract and retain their high-performing independent workers, the engagement goes rogue lead to increased administrative burden, risk and high costs as discussed above.

3. Flexible engagement:

- Considers the worker experience and enables independent talent to work the way they want, whether as a 1099, corp-to-corp, or on the W-2 payroll

- provides tailored communication and resources for talent to assess and improve their compliance

- Mitigates misclassification risk by ensuring all practices conform to state & federal requirements for each engagement method

- Prioritizes cost savings through centralized and/or tech-enabled attribution and efficient processes

- Payroll markups can be reduced, and cost benefits realized from avoiding the fines and penalties associated with misclassification

- Builds brand equity across the independent landscape

Independent professionals are an essential part of talent ecosystems and even with the best ongoing classification efforts, Gray Zone workers will be a significant part of any talent ecosystem, no matter their seniority or skill set. Continually improving communication to correctly classify and holistically manage this segment of your workforce will help enterprises to keep pace with the changing world of work.

To transition to a holistic program that includes gray zone independent professionals, many organizations today are choosing to partner with a firm like MBO Partners that specializes in independent contractor engagement and compliance.

Case Study: Situation, Solution, and Results

Here’s a real-world example that illustrates the potential of a flexible engagement method:

Client: A Fortune 500 cloud computing company

Situation:

- With the war for tech talent heating up and their need for contingent talent increasing, the company recognized it was struggling to attract and retain high-performing independent contractors.

- Managers did not follow consistent processes or categorization best practices when engaging contractors, which led to:

- Lack of visibility into program spend

- Compliance oversights

- Increased misclassification risk

- Escalating expenses

- Ambiguous experiences for their independent contractors

- High attrition rates

- The company did not have the expertise in-house to effectively address the situation in a scalable way along an aggressive timeline.

Solution

- MBO worked with the company to audit their existing program and develop a flexible engagement model for a formal compliance and engagement program. This included:

- Updating their policies and integrations for contingent workers

- Developing an initiative to restructure engagement of any non-employee worker

- Creating a simplified, compliant process for independent talent engagement and onboarding

- Establishing a direct sourcing initiative through MBO’s marketplace

Results

- Since implementing their centralized, tech-enabled program, the company has mitigated their misclassification risk and is now efficiently tracking and managing their independent contractor spend.

- The company has realized an estimated savings of over $1.4 million in annual operating costs.

In this guide

Subscribe to the Insights blog to get weekly insights on the next way of working

Related posts

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top independent contractors for your projects.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.