5 Ways to Know if You Should Hire an Independent Contractor, Temp, or FTE

- The modern workforce can consist of a variety of talent and knowing when to hire an independent contractor vs a temp or a full time employee can impact how quickly work gets done and your bottom line.

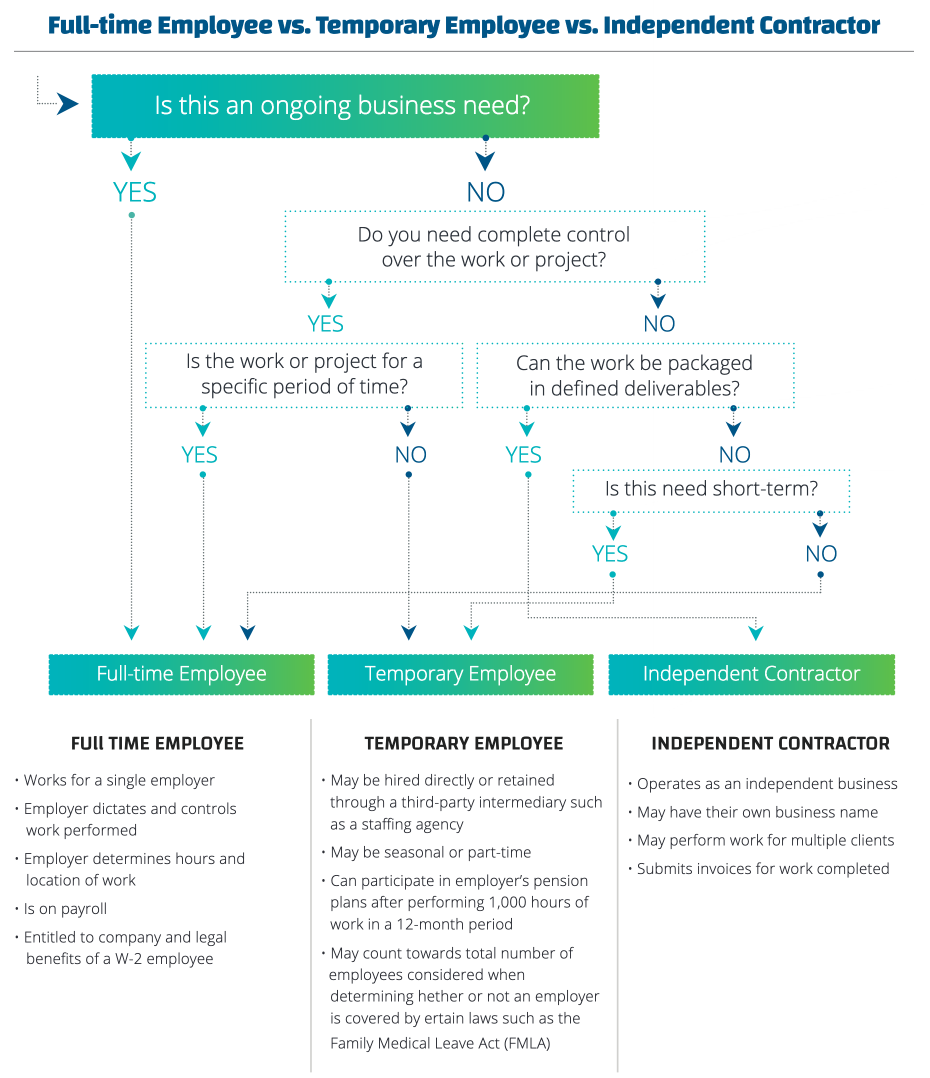

- Determine how much control you need to have over the work and if it's an ongoing business needs before deciding on which type of worker to hire.

- Independent contractors can work on long and short term projects based on your needs and if a project can be defined in packaged deliverables, engaging an independent worker may be the best choice.

The modern workforce can consist of a variety of talent and knowing when to hire an independent contractor vs a temp or a full time employee can impact how quickly work gets done and your bottom line. Businesses are increasingly relying on the independent workforce—the millions of Americans who work as contractors, consultants, freelancers, side-giggers, and more—to fill talent needs, and it’s important to understand when independent workers are your best option. Contingent workers can help increase organizational agility, help businesses operate at full capacity, and allow companies to develop or improve products and services.

However, there are many details that must be taken into consideration when deciding to bring a temporary worker, full-time employee, independent contractor on board. There are rules and regulations that govern the engagement of each type of these workers as well as practical applications to consider.

Before deciding on the best type of talent for a particular project or job, it is helpful to understand the differences between each worker. Ask yourself the following questions or use the infographic below to determine which type of talent is best suited to your company’s needs.

1. Is This an Ongoing Business Need?

Full-time employees are often the ideal solution for handling constant, ongoing business needs. With a full-time employee, a manager can have full control the work being performed and control the hours and location of the work.

Temporary workers may be helpful in fulfilling a seasonal or short-term need, but they are subject to certain regulations and may require additional fees if retained through a third party like a staffing company. Independent contractors tend to be the most flexible route for short-term project needs, providing access to specialized expertise and a wide pool of talent to choose from.

2. How Much Control Do I Want Over the Work?

If the project or work you need completed could be considered a core competency of your company, it should, for the most part, be managed internally with full time employees. You can, however, support these core competencies with independent talent as needed.

Just keep in mind that control is a key determinate in properly classifying independent contractors. When you engage independent talent, you are managing a business-to-business relationship. Independents have full control over when, where, and how their work is performed.

3. Is This a Project with a Definitive Timeline?

Independent contractors allow companies to acquire talent for a specific period of time without an ongoing commitment—financial or otherwise. Full-time employees are a better fit for work that is ongoing or unable to be defined.

4. Can the Work be Packaged in Defined Deliverables?

If a project or work has clearly defined success metrics and can be articulated into a deliverable, independent talent can be a good option. Independent contractors are responsible for performing the services outlined in a contractor Scope of Work (SOW).

On the other hand, if you simply need more people to perform a job that internal employees are already doing, that gap should be filled by a full-time or temporary employee.

5. Is This a Short-Term or Constant Need?

Consider whether your business need fluctuates or if it is constant. If the need is short-term or seasonal, an independent contractor or temporary employee may be the way to go, giving you the flexibility to pay for a resource as needed. If the demand is constant, consider hiring a full-time employee. Independent contractors can be engaged for a long-term project, so long as the project has very clear objectives and can be easily communicated and measured.

Discover more about these different worker types in our guide: Independent Contractor, Temp, or Full-Time Employee?

The information provided in the MBO Blog does not constitute legal, tax or financial advice. It does not take into account your particular circumstances, objectives, legal and financial situation or needs. Before acting on any information in the MBO Blog you should consider the appropriateness of the information for your situation in consultation with a professional advisor of your choosing.

Categories

Subscribe to the Insights blog to get weekly insights on the next way of working

Source, engage, and manage top talent talent through MBO's direct sourcing platform

Learn more about MBO

Learn how to start, run and grow your business with expert insights from MBO Partners

Learn how to find, manage and retain top-tier independent talent for your independent workforce.

MBO Partners publishes influential reports, cited by government and other major media outlets.

Research and tools designed to uncover insights and develop groundbreaking solutions.