MBO helps enterprises compliantly engage independent professionals globally. Supporting talent in more than 100 countries, MBO ensures complete risk management for your contingent workforce around the world.

Need for geographic flexibility spurs international solutions

Companies optimizing workforce strategies recognize that today's independent talent is taking projects across borders. Unlike the past "global worker," clients and independents now seek engagement solutions that offer geographic flexibility in various forms.

MBO solutions work for all types of international engagements

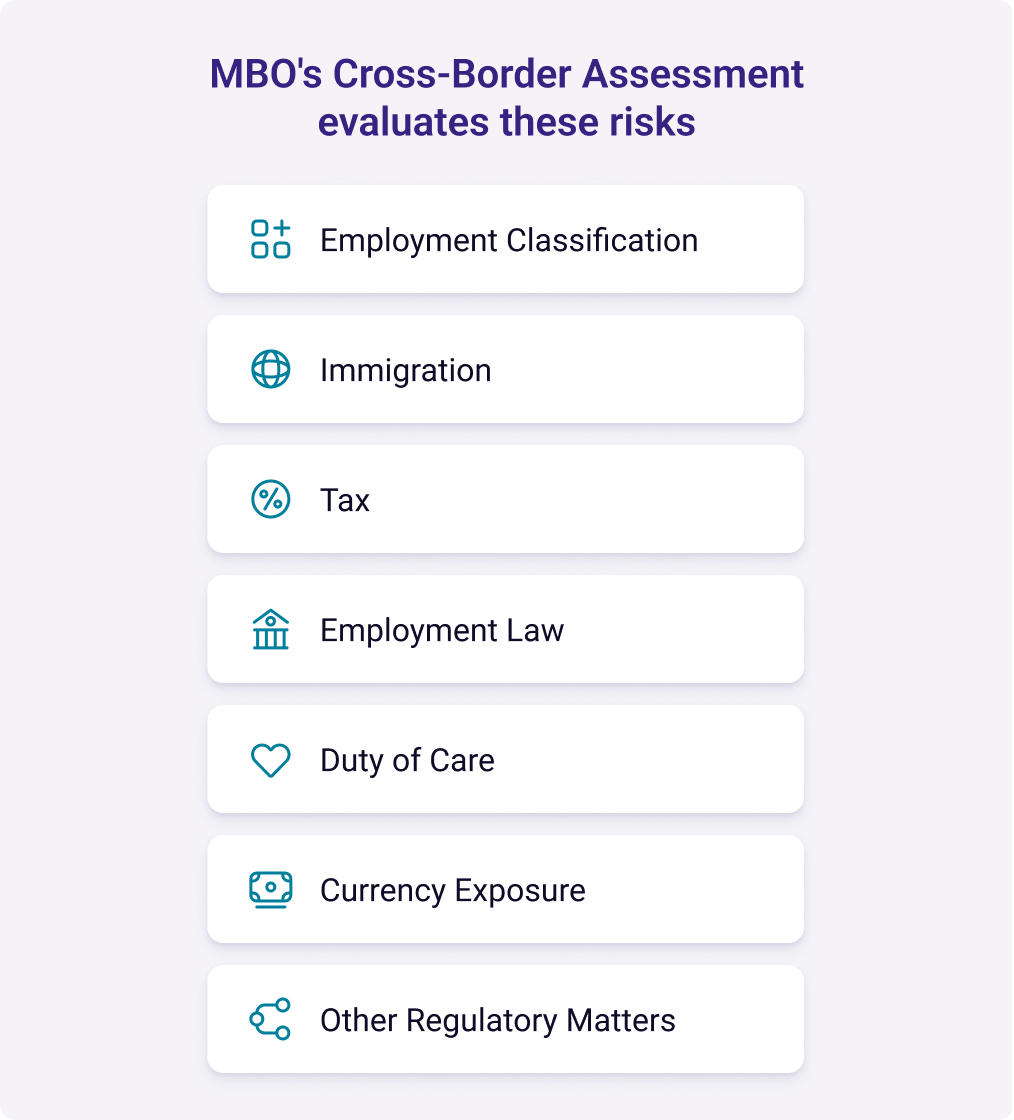

MBO's international engagement solution offers a cross-border assessment to ensure compliance with local regulations. Supported by subject matter experts, this assessment determines if MBO can directly engage talent or if its international partner network is needed.

Direct engagement through MBO

Talent receives engagement guidance to work abroad safely and compliantly. Enterprises receive same degree of compliance as if the talent worked in the U.S.

Compliance with work country employment classification rules

Guidance on immigration and taxes

Compliance with other cross-border issues

Insurance for the safety and well-being of Talent

Both MBO and the talent benefit from working through our partner network

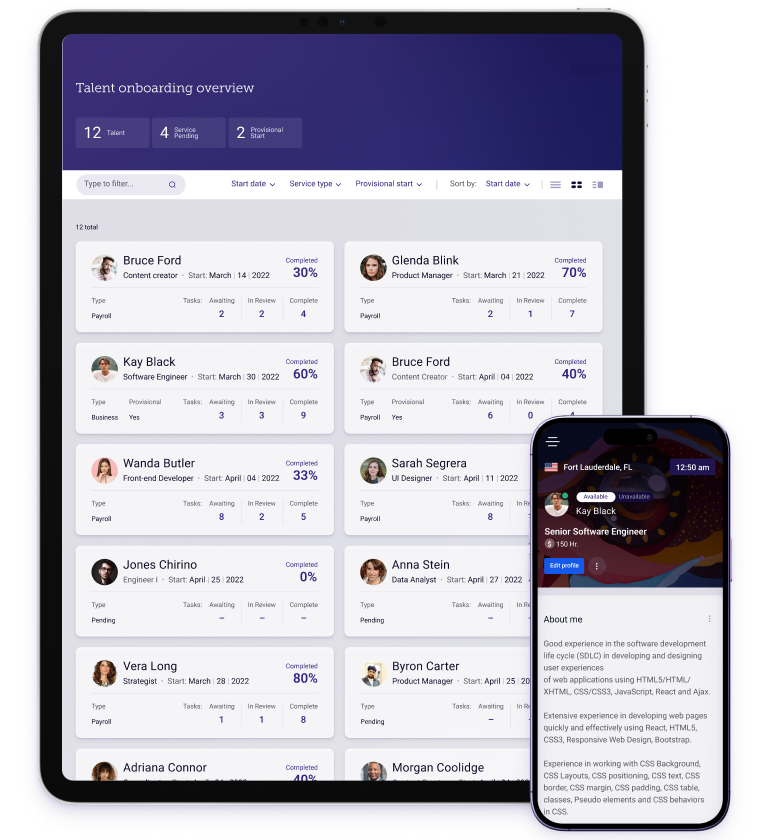

MBO provides enterprise clients a single point of contact, a single invoice and currency capability, and a seamless enrollment process for talent.

Talent receive in-country expertise and support, are paid in local currency if required and/or desired, and MBO payment support and back-office services.

Key benefits

How MBO's solution enhances global reach

Leverage MBO's comprehensive global solutions to maximize your independent workforce.

Leverage MBO's comprehensive global solutions to maximize your independent workforce.

Gain a competitive edge

Geographic flexibility with MBO's solutions offers enterprises a significant edge by accessing a diverse and skilled global workforce.

Become the client of choice

Simplify international engagements to make your company the top choice for global talent with MBO's streamlined processes.

Achieve greater agility

MBO's virtual work and streamlined engagement solutions enable your enterprise to quickly adapt to changing market conditions and business needs.

Embrace diversity

Enhance innovation and foster new ideas through global diversity and inclusion with MBO's solutions, bringing together a wide range of perspectives.